Pay Later

- The first T/T payment method

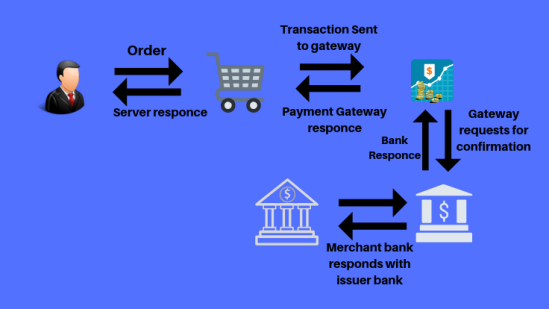

The T/T payment method is settled in foreign exchange cash, and you remit the money to the foreign exchange bank account designated by our platform.

T/T have prepaid, spot and forward. Our platform now uses 30% prepaid and 70% spot. That is, on the day of order placement, you will pay 30% of the order amount to the foreign exchange bank account designated by our platform. After the order is ready for delivery according to the order date, we will provide the packing list information, and you will pay the 70% balance. , We arrange cargo transportation links (such as air, sea, rail) freight forwarding companies can use our recommendation and you can choose by yourself.

- Business risk

1. The buyer is bankrupt or unable to repay the debt;

2. The buyer defaults on the payment;

3. The buyer refuses to accept the goods;

4. The issuing bank goes bankrupt, ceases business or is taken over;

5. When the documents match, the issuing bank defaults or refuses to accept under the forward credit item.

- Political risk

1. Refers to the country or region where the buyer or the issuing bank is located that prohibits or restricts the buyer or the issuing bank from paying the insured's payment for goods or letter of credit;

2. Prohibit the import of the goods purchased by the buyer or revoke the import license issued to the buyer;

3. War, civil war or riots have caused the buyer's failure to perform the contract or the issuing bank's failure to perform the payment obligations under the letter of credit;

4. The third country through which the buyer or the issuing bank pays shall issue a payment deferment order.

5. When the documents match, the issuing bank defaults or refuses to accept under the forward credit item.

- Loss compensation ratio

1. The maximum compensation rate for losses caused by political risks is 90%.

2. The maximum compensation rate for losses caused by other business risks such as bankruptcy, insolvency, default, etc. is 90%.

3. The maximum compensation rate for losses caused by the buyer's rejection of the goods is 90%.

4. The highest participation rate under the export credit insurance (Forfeiting) insurance policy can reach 100%.

5. The maximum compensation rate under comprehensive insurance for SMEs is 90%.

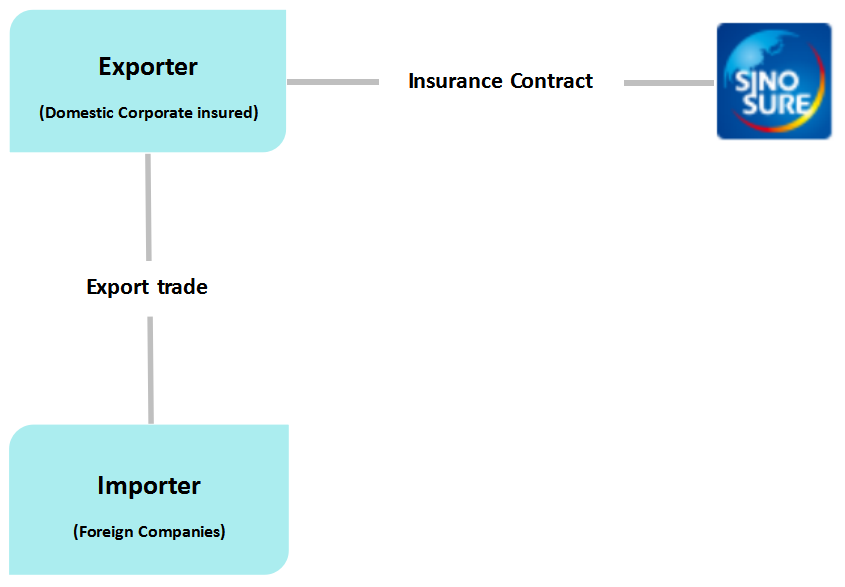

Short-term export credit insurance provides coverage for the risk of receivables collection for goods or services exported from China by letter of credit or non-letter of credit. The credit period of the insured business is generally within one year and up to two years.

1. Comprehensive insurance.

This product compensates exporters for direct losses resulting from the occurrence of political risks or commercial risks after the export of goods as agreed in the contract or in the letter of credit.

2. Comprehensive insurance for small and medium-sized enterprises.

This product covers the risk of collection of accounts receivable arising from all exports made by small and medium-sized enterprises under letters of credit and non-letters of credit payment.

3. SME Credit Insurance Easy.

This product is China Credit Insurance's exclusive export collection risk protection solution tailored for small and micro enterprises, with zero thresholds and zero restrictions, single payment and year-round protection; simple billing and timely payment of claims.

4. Pre-Export Rider.

This product is an additional insurance product to the short-term export credit insurance comprehensive insurance, which mainly covers the credit risk occurring before the export of goods.

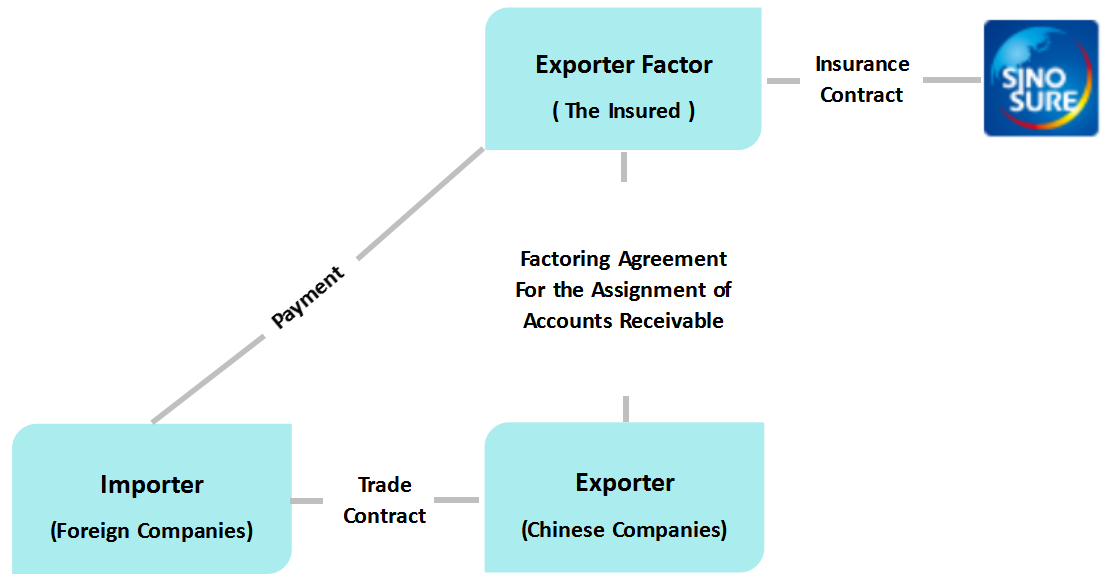

1. Export Credit Insurance (Bank) Policy

This product, with the bank as the insured, protects the bank against direct losses arising from the commercial risks of the foreign buyer and the political risks of the country in which it is located, after it has bought the exporters' accounts receivable (bank export factoring).

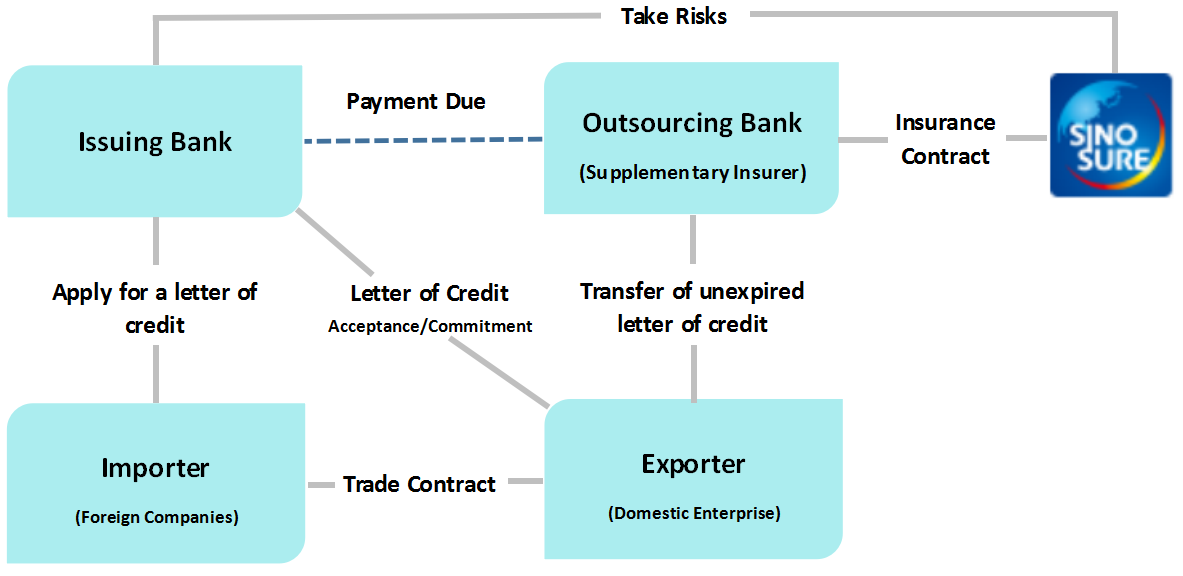

2. Export Credit Insurance Policy (Forfeiting)

This product, for which the bank is insured, protects the bank against direct losses due to non-payment by the foreign issuing bank upon the expiry of the exporter's outstanding claims under the term letter of credit, which the bank has accepted or agreed to pay without recourse under the forfeiting.

中文

中文 English

English Español

Español Français

Français